tax avoidance vs tax evasion nz

Tax avoidance uses legal methods to lower taxes. Sometimes taxpayers tax plans are right on the edge of tax evasion or tax avoidance.

Tax evasion and tax avoidance have the same goal.

. 8 John Prebble and Zoe Prebble The Morality of Tax Avoidance 2010 20 Creighton L Rev 101 at 112. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of.

Do jobs under the table for cash and hide some or all of that income. Tax evasion uses illegal means not to pay taxes. These people are considered tax criminals.

Not reporting all your income in an all-cash business andor not. In tax evasion you hide or lie about your income and assets altogether. This article will shed light on more information and how to avoid getting into trouble with the government.

Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed. In contrast tax avoidance uses legal means to lower the amount of taxable money on which an individual or organization owes. People who cheat the tax system are tax criminals.

Tax evasion is a federal offense which means if you are found guilty of it in one state you may face sanctions and restrictions all over the country. Tax planning and using IRS-approved tax strategies are the best examples of tax avoidance. Tax crime happens when people cheat the tax system through deliberate and dishonest behaviour so they can get some kind of financial benefit.

As a result you need not cheat and get. You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401 k plans. 10 Blacks Law Dictionary 9th ed 2009 Tax Evasion at 1599.

The difference between tax evasion and tax avoidance is not complicated. It is a legal strategy that taxpayers can use to legitimately lower their IRS tax bills. 11 John Prebble Criminal Law Tax Evasion Shams and Tax Avoidance.

Having tax software can help you manage stuff like this legally. Most commonly tax avoidance is done through claiming as many deductions and credits as possible. Tax evasion is an illegal activity in which an individual or organization purposely.

Tax avoidance is organizing your undertakings with the goal that you pay a minimal measure of tax due. Part I Tax Evasion and General Doctrines of Criminal Law 1996 2 NZ J Tax L Policy 1 at 4. There are a series of legitimate ways approved by the IRS to lower your tax bills.

Do not declare their income at all. But the main difference between tax avoidance and tax evasion is how this goal is accomplished. While similar in name tax evasion and tax avoidance are different in a big way.

To lower the amount of taxes you have to pay. While the two appear similar in meaning their characteristics penalties and administrative processes are quite different. The distinction between tax evasion and tax avoidance to a great extent comes down to two components.

In addition taxpayers found guilty of tax evasion may have to pay. What tax crime is Everyone pays tax on their income to help fund public services. People guilty of tax evasion can face up to five years in jail a fine up to 250000 as individual or 500000 as the company.

Tax Evasion vs. Popular usage and prevalent attitudes. While you get reduced taxes with tax avoidance tax.

Tax Evasion is hiding income from the IRS and lying on tax returns and these acts must be intentional and deliberate. How we deal with tax crime Were committed to dealing with people who deliberately avoid pay their fair share of tax including prosecuting them if needed. Tax evasion is lying on your personal tax structure or some other structure says Beverly Hills California-based tax.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax evasion however is illegal. Tax Avoidance is using legal means to reduce your tax liability.

This article will first outline the difference between tax evasion and tax avoidance and then demonstrate the different investigation and. In tax avoidance you structure your affairs to pay the least possible amount of tax due. Getting your tax right Its easier to get your tax right.

Tax Avoidance Vs Tax Evasion Infographic Fincor

Estimating International Tax Evasion By Individuals

Explainer The Difference Between Tax Avoidance And Evasion

What Is Tax Evasion It S A Crime Freshbooks

Tax Evasion Tax Avoidance Definitions Differences Nerdwallet

Explainer What S The Difference Between Tax Avoidance And Evasion

The State Of Tax Justice 2020 Eutax

Estimating International Tax Evasion By Individuals

Opinion This Is Tax Evasion Plain And Simple The New York Times

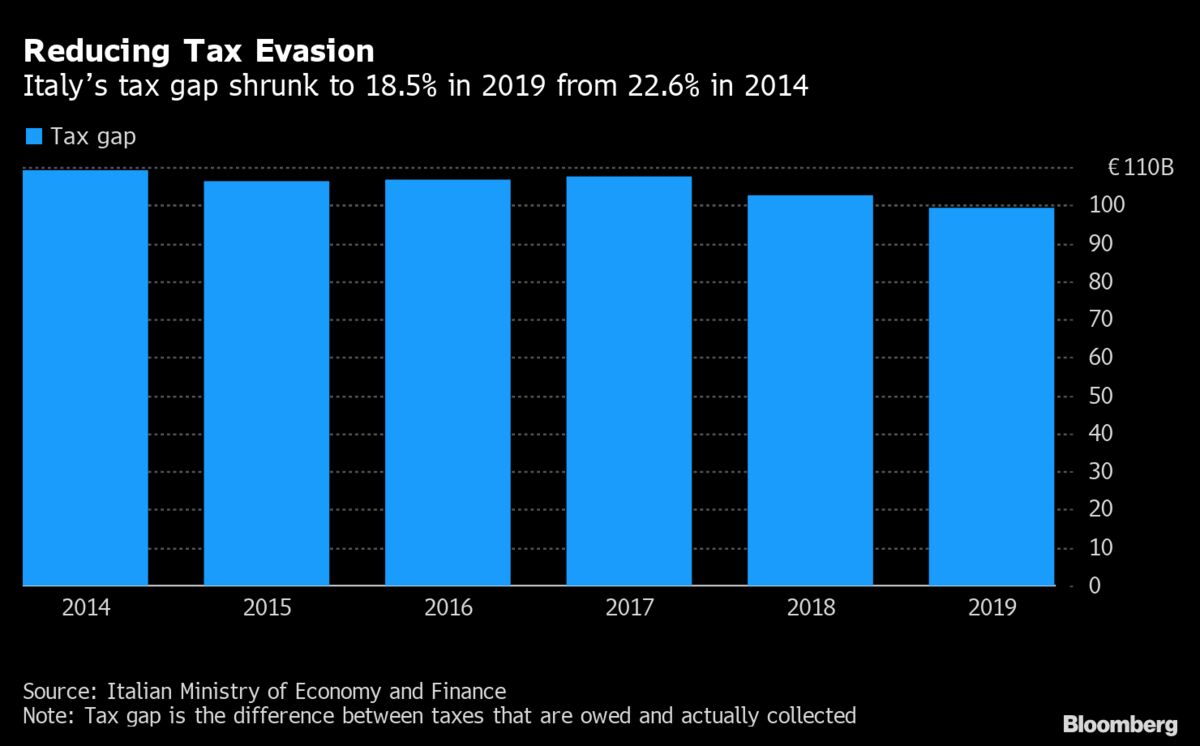

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Explainer What S The Difference Between Tax Avoidance And Evasion