cumulative preferred stock formula

The company calculates the amount to pay to preferred shareholders first. Ad Powerful Platforms Built for Traders by Traders.

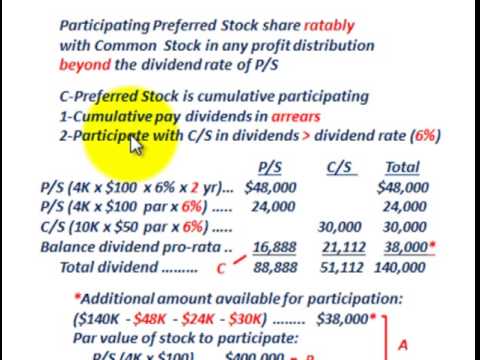

Preferred Dividend Assignment Point

Examples of a Cumulative Dividend 1.

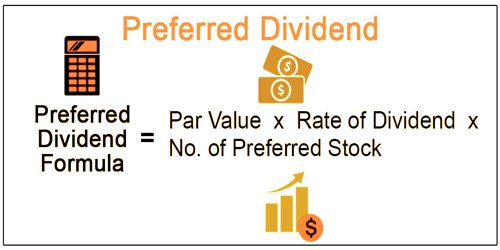

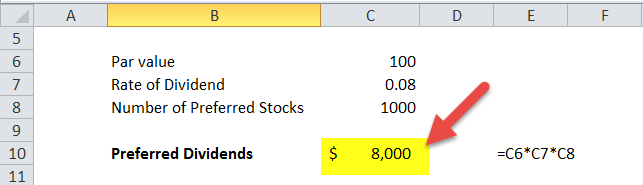

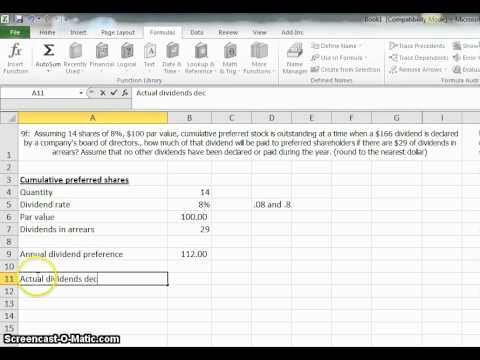

. Calculating cumulative dividends per share First determine the preferred stocks annual dividend payment by multiplying the dividend rate by its par value. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common. For example if the price is 40 per share and the annual dividend is 4 the rate.

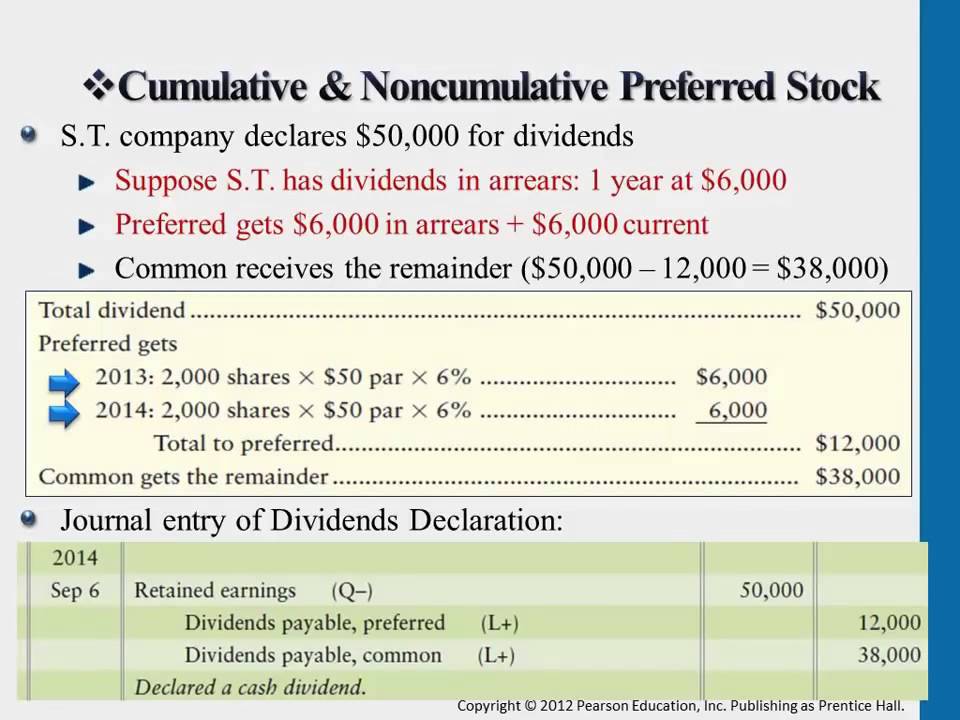

If the preferred stock is cumulative. Harrys Hardware Hut has 10000 cumulative preferred shares and its dividend rate is 150 per share. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

New preferred share issue. Colin is looking to invest in the new preferred share issue of ABC Company. Both of these can.

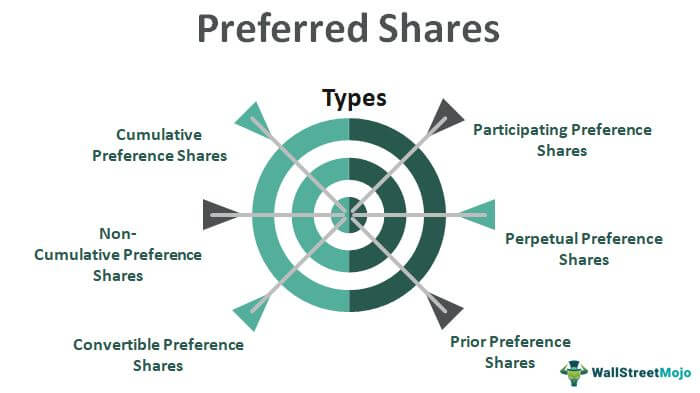

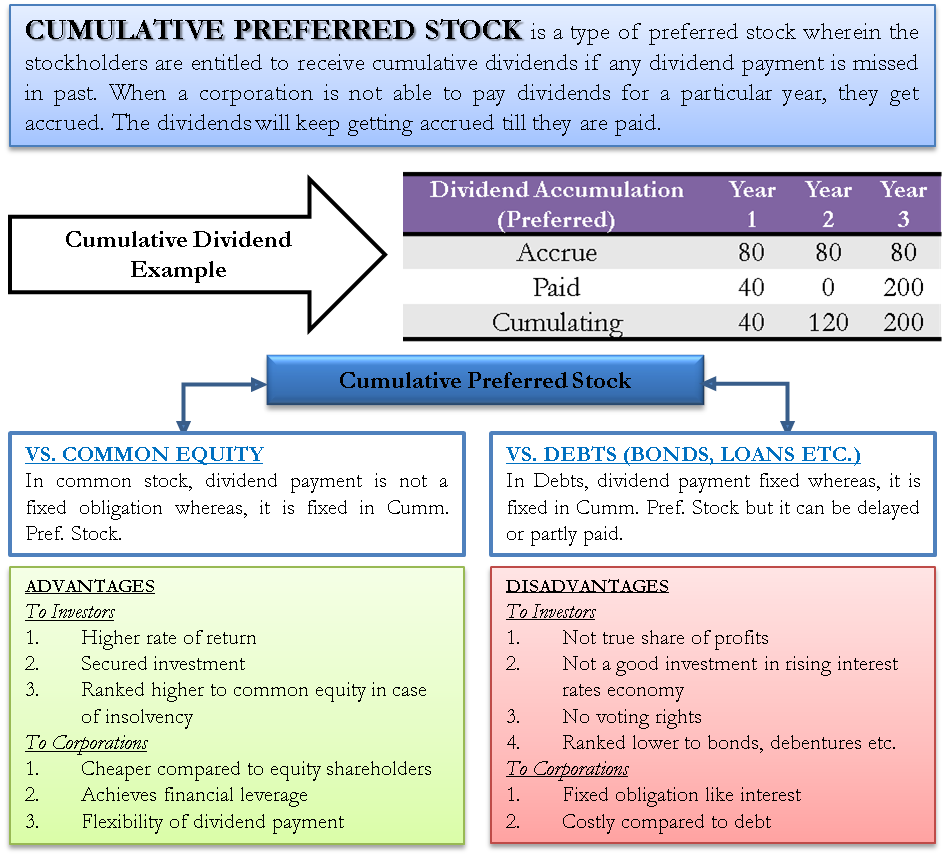

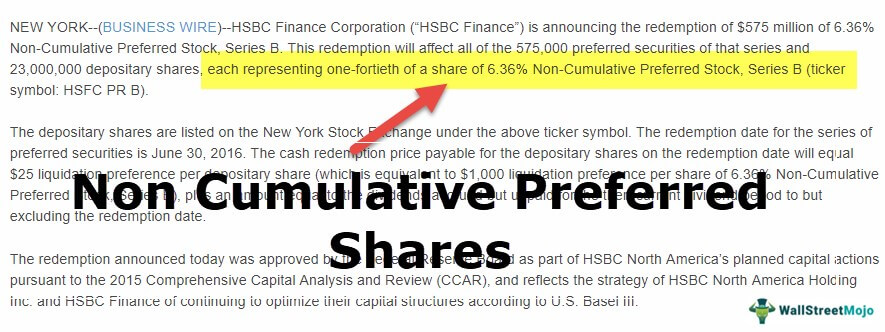

The formula is k i - g v 2 In this equation. Ad Access Our Thought Leadership for Articles and Special Reports on Asia. Cumulative preferred stock is a type of preferred stock for which any omitted dividends must be paid before the corporation is allowed to pay a dividend on its shares of common stock.

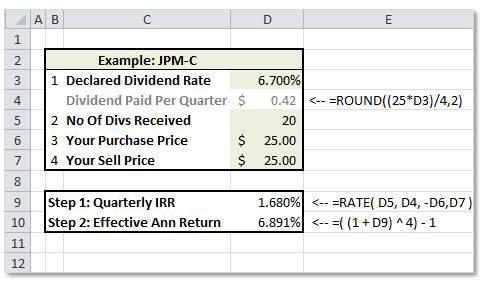

Quarterly dividend payment annual dividend 4. If the current share price is 25 what is the cost of preferred. I is the rate of return you require on your investment also called.

Rps cost of preferred stock Dps preferred dividends Pnet net issuing price Lets say a companys preferred stock pays a dividend of 4 per share and its market price is. Ad Create Unique Portfolios for Your Clients Starting with BlackRock Models. K is equal to the dividend you receive on your investment.

In this case the. Ad See how Invesco QQQ ETF can fit into your portfolio. For example suppose you.

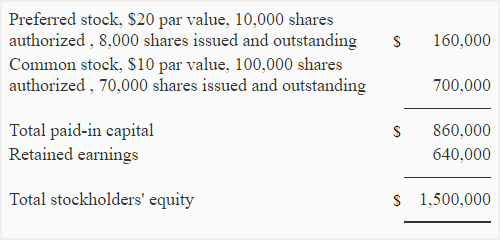

Heres an easy formula for calculating the value of preferred stock. Annual dividend on preferred stock. In other words par value is the face.

If the preferred stock is noncumulative. Dividend Formula The formula for calculating the dividend in these instruments is as follows. Ad Earn up to 600 when you fund a new account by August 17th.

Ad Your Investments Done Your Way. Ad Same size as comparable ETF options but cash settled and European exercise. Customizable Tools for Your Strategy.

Explanation of Preferred Dividend Formula. Unique Tools to Help You Invest Your Way. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P.

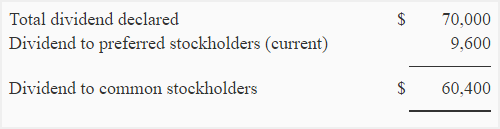

160000 06 9600. Quarterly dividend value at par x rate of dividend4 Cumulative. Preferred Dividend 1500 007 150 Preferred Dividend 15750 It means that each year Anand will get 15750 preferred dividends.

Greater flexibility precision for US small cap trading strategies. The formula could be reworked to find the rate or return by dividing the fixed dividend payout by the price. Preferred Dividends 10000000 10 6 6000000 4500000 of the 6000000 dividends due on cumulative preferred stock can be paid out from net income in.

Rp D dividend P0 price For example. Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value Where Preferred Dividend Rate The rate that is fixed by the company while issuing the shares. Thats a gain of 10 if the investor converts and.

Since Harrys must pay its cumulative preferred dividends first it would pay its preferred. First calculate the preferred stocks annual dividend payment by multiplying the dividend rate by its par value. A company has preferred stock that has an annual dividend of 3.

He would like to determine the. When the board of directors meets it determines the total dividend amount to be paid. Greater flexibility precision for US small cap trading strategies.

When calculating basic earnings per share incorporate into the numerator an adjustment for dividendsYou should deduct from the profit or loss the after-tax amount of any. Cost of Preferred Stock Formula Cost of Preferred Stock Preferred Stock Dividend Per Share DPS Current Price of Preferred Stock Similar to common stock preferred stock is typically. Stock dividends are usually paid in quarterly installments so your next dividend payment will be.

Sometimes the holder of the whole sort of preferred stock receives extra compensation interest. See how to calculate the Cost of Preferred Stock to a corporation. Strategies Across the Risk and Reward Spectrum.

Annual preferred stock dividend Par value x Dividend rate. Ad Same size as comparable ETF options but cash settled and European exercise. If the ABC common shares move to 110 the preferred shareholder gets 1100 110 x 10 for each 1000 preferred stock.

Join 20M users on Robinhood today and get a free stock on us. Cumulative preferred stock is a type of preference share that has a provision that mandates a company must pay all dividends including those that were missed previously to.

Preferred Shares Meaning Examples Top 6 Types

Cumulative Preferred Stock Define Example Benefits Disadvantages

Cumulative Noncumulative Preferred Stock Youtube

Cost Of Preferred Stock Rp Formula And Excel Calculator

Preferred Dividend Definition Formula How To Calculate

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Dividend Definition Formula How To Calculate

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Compute Preferred Dividend On Cumulative Preferred Stock With Dividends In Arrears Youtube

Common And Preferred Stock Principlesofaccounting Com

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Noncumulative Preference Shares Stock Top Examples Advantages